Niemcy: jak będzie wyglądać przyszłość fotowoltaiki bez dopłat?

German PV market racing towards post-FIT era, analyst says

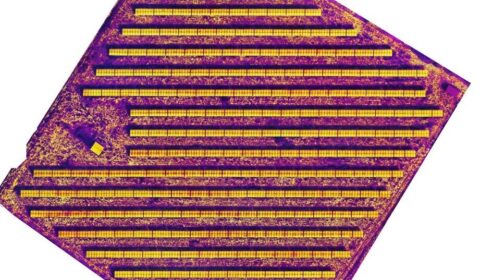

Germany’s PV market continues to confound predictions, with consensus building behind the notion that it has now entered a protracted period of boom until the 52GW feed-in tariff (FIT) cap has been reached – and after that, the sky is the limit.

Controversy raged across the German PV industry in early 2012 – from the parliamentary dogfight over new FIT changes, to the sacking of the energy minister, to the seemingly never-ending parade of new bankruptcies.

Yet the country nevertheless managed to put up 4.3GW of new capacity during the first six months of the year, according to new figures published by the federal network agency.

That compares to the government’s annual “target corridor” of 2.5-3.5GW of new installations – lending further credence to those who believe the German market simply cannot be contained.

Nearly half of that 4.3GW was added in June, which may represent the final boomlet for the German market, which has gained notoriety for its installation frenzies just before FIT changes take effect – typically at the end of the calendar year.

An astounding 55% of the 7.5GW added in Germany last year came during the month of December.

But the new FIT rules – finally approved on 27 June and retroactive to 1 April in many cases – mean that installation patterns will change dramatically going forward, according to Henning Wicht, director of PV advanced products at IHS iSuppli.

In contrast to the annual FIT reduction of years past, the FIT will now be lowered on a monthly basis, with a maximum annual degression of 29%.

The entire FIT programme will be taken off line when Germany hits 52GW of installed PV capacity – up from about 28GW today.

Many experts believe the market will essentially race towards the 52GW mark, and get there in as little as three years – dynamiting the government’s preferred pace of installation, and spurring drastic changes in the way the country consumes, stores and transmits electricity.

Already, Germany has shown itself capable of producing half of its electricity needs from PV during daytime on sunny weekends, when power demand is relatively low.

In June, PV covered 5.3% of Germany’s total electricity requirements – compared to 4% during the whole of 2011.

By contrast, wind accounted for 9.2% and biomass 5.7%.

Wicht believes Germany will add 7.3GW of new PV capacity this year, with just 28% coming on line in the fourth quarter.

He predicts installations will dip again slightly next year, before lifting off from 2014, at which point Germany will begin entering a post-FIT period – when many investments pay off even without incentives.

However, whether or not embattled global module makers have fully grasped the new reality of the all-important German market is an open question.

Wicht warns that should module makers flood Germany with panels in anticipation of another fourth-quarter boom, they would “incite another cycle of price declines” – likely tipping many more players into bankruptcy.

First Solar recently opted to continue running its German production lines for a bit longer due to a softer-than-expected landing in Germany. Those lines will be shut permanently by the end of the year.

Of the top 60 companies operating in the PV space – including both manufacturers and project developers – 20 have either gone bankrupt or closed all of their manufacturing facilities, according to iSuppli.

Germany’s solar FIT costs ratepayers €4bn ($4.9bn) per year on top of their regular electricity bills.

However, that looks like a bargain compared to the more than €6bn Italy spends each year on PV subsidies, despite having less than half the total installed capacity.