5, 10, 15 GW?

Fotowoltaika w Chinach do 2015 r.: 5, 10, 15 GW?

Chińskie władze co jakiś czas podnoszą cel zainstalowanej mocy systemów fotowoltaicznych do roku 2015. Dlaczego?

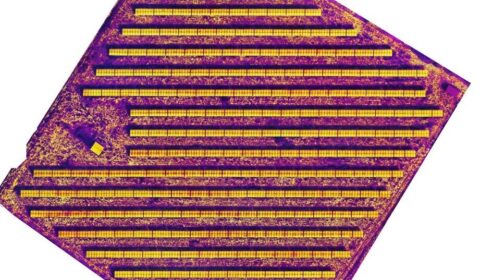

Chiński, pięcioletni plan gospodarczy, którego realizacja ma się zakończyć do roku 2015, zakładał wstępnie, że w Państwie Środka do tego czasu zainstalowanych zostanie 5 GW paneli fotowoltaicznych. Pod koniec ubiegłego roku cel zwiększono do 10 GW, a obecnie wynosi on już 15 GW.

China, it appears, might be ready to step up and do its part in deploying more of the vast solar photovoltaic capacity it is producing. Will it be enough to make everything OK in the beleaguered solar manufacturing sector? No, but it sure won’t hurt.

Earlier this month, China’s renewable energy division put out word that the country would boost its target for solar energy installation to 21 gigawatts in the current five-year plan, which runs through 2015.

The move was characterized as a quadrupling, and indeed 5 GW had been the 2015 goal spelled out in the original 12th Five-Year Plan. But with domestic solar production exploding, the target was ratcheted up to 10 GW before the end of last year, and subsequently it was raised by another 5 GW to 15 GW.

Most significantly for the global solar manufacturing sector, devastated by overcapacity, the Chinese are aiming to frontload much of their deployment, with 5 to 7 GW of PV installations in 2012, according to industry analyst IMS Research.

IMS said ground-mount utility-scale projects in desert regions will be joined by new commercial installations, forecast to increase their market share by 13 percent in 2012. “A more diverse range of system types will emerge in 2012, largely driven by China approving 1.7GW of projects under the Golden Sun Scheme,” said Frank Xie, IMS senior PV market analyst and author of the report.

China in the past few years has become the world leader in wind power capacity, but its solar deployment has lagged. The new, more aggressive posture on solar by the Chinese isn’t coming a moment too soon.

“With European demand set to shrink from the second half of 2012, China’s domestic market will become increasingly important,” the firm said in a statement. “China’s latest move will help to support the huge amount of production capacity added by Chinese suppliers in the last two years by expanding domestic demand.”

China’s plan for 2012 will make it one of the world’s biggest solar markets. In 2011, Germany added 7.5 GW of capacity, but EuPD Researach in Bonn is forecasting that 2012 will see just 5.9 GW of new installations as the country.

“In Q4’12, China is set to dominate both PV (photovoltaic) module supply and market demand for the first time ever,” industry watcher Solarbuzz said. And it added that other Asia-Pacific nations will see growth, including India, Australia and perhaps most significantly Japan. There, a new, generous feed-in tariff is expected to grow the market significantly.

As for where the United States stands in this, it installed 1.9 GW in 2011, and the Solar Energy Industries Association expects about 2.8 GW to go in this year.

Meanwhile, at the behest of several solar manufacturers, the U.S. is moving toward finalizing duties on Chinese PV imports. One nugget from IMS highlighted exactly why: the firm said China crystalline PV module capacity hit 32.6 GW in the first quarter of this year, outstripping the forecast of 30.6 GW for 2012 global installations.

“Although the outlook for PV demand in China is positive, price erosion is set to continue in 2012 as overcapacity still exists in the polysilicon, wafer, cell and module supply chain,” the firm said.